A feature of many 401(k) preparations is the ability to acquire of on your own. To put it differently, you can borrow money which you resulted in the plan, in this particular limits, and you may shell out on your own right back.

They are a whole lot more correctly called the capability to supply an effective percentage of your own old age package money-always to $fifty,000 or 50% of your own possessions, almost any are quicker-toward a taxation-100 % free foundation. You then need to repay the money you’ve got accessed under legislation designed to heal your own 401(k) decide to everything their new condition because if your order got perhaps not occurred.

A new complicated concept on these deals is the term attract. One notice charged into the mortgage equilibrium was paid down by the new new member toward participant’s own 401(k) account, so technically, in addition, it is actually a transfer from one loans in Broomtown of the pouches to help you another, perhaps not a credit costs otherwise losings. As a result, the cost of a good 401(k) mortgage on the old-age deals advances should be limited, basic, otherwise confident. In many cases, it might be less than the expense of investing genuine notice on a lender or personal bank loan.

Top 4 Reasons why you should Use from your 401(k)The major four reasons to seek out your own 401(k) having serious short-identity dollars requires was:Speed and you will ConvenienceIn extremely 401(k) plans, asking for that loan is quick and simple, requiring zero lengthy apps or credit monitors.

Very arrangements make it mortgage cost is generated conveniently through payroll deductions-having fun with once-tax bucks, even though, perhaps not the new pre-taxation ones funding their package

Of numerous 401(k)s allow it to be loan applications to get made with a few clicks on the a site, and you can has funds on your hand in several months, that have complete privacy. You to definitely innovation now being accompanied by the particular preparations try a debit cards, whereby several financing can be produced instantaneously into the lower amounts.

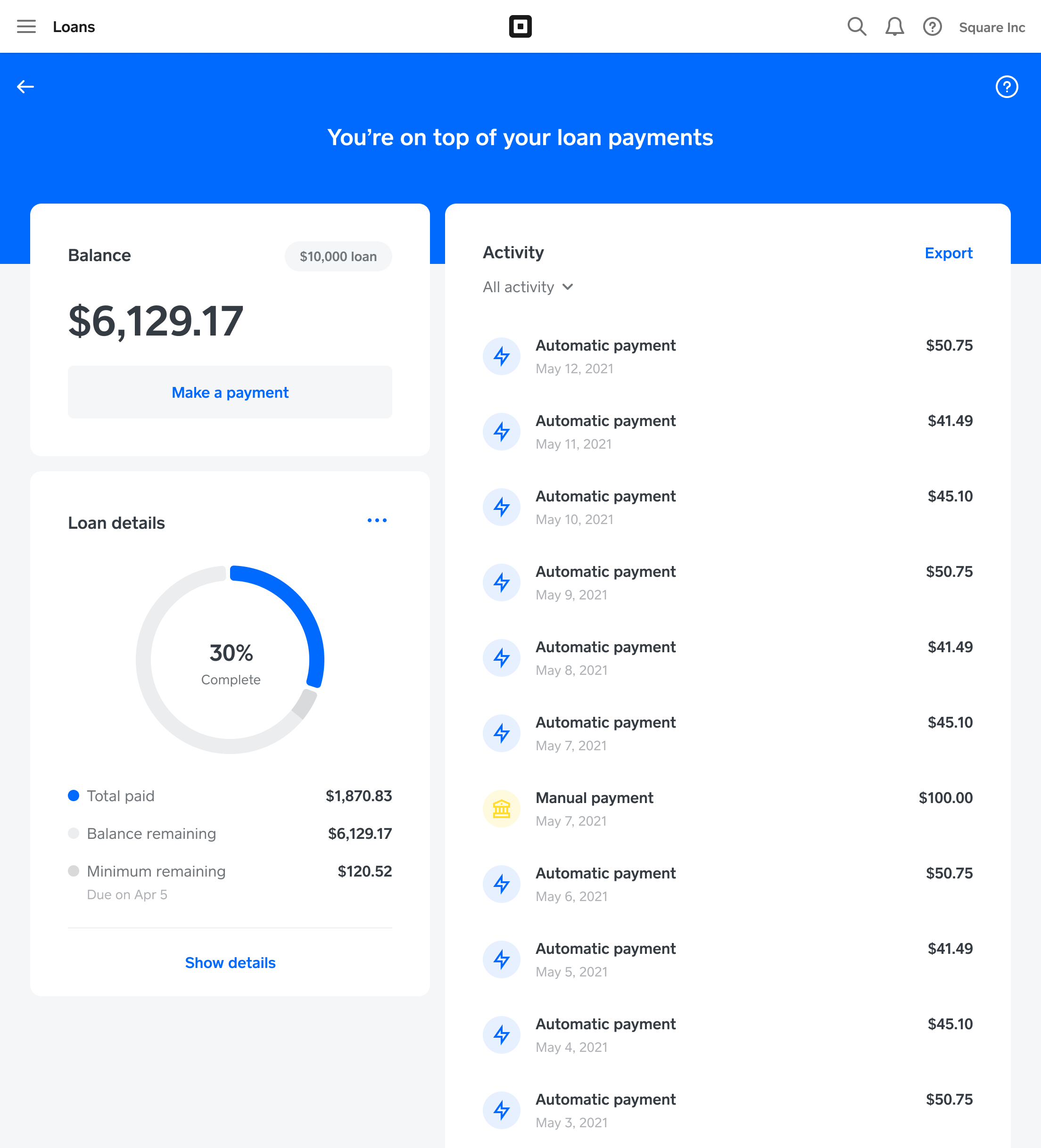

Repayment Self-reliance Even when statutes indicate a beneficial five-season amortizing installment schedule, for the majority 401(k) finance, you can pay back the master plan financing faster no prepayment penalty. Your bundle statements let you know credit for the financing account plus remaining prominent harmony, just like a consistent financial loan declaration.

Rates Advantage There isn’t any rates (besides perhaps a modest mortgage origination otherwise management fee) so you can tap your own 401(k) money to own short-term liquidity demands. Here’s how it usually performs:

Theoretically, 401(k) fund are not true funds, because they do not cover sometimes a loan provider otherwise an assessment of your credit rating

Your establish the newest funding account(s) where we wish to borrow money, and people investment is actually liquidated during the course of the loan. Hence, you clean out people self-confident earnings who would was basically created by men and women investment for a short span. If in case the marketplace was off, youre offering these opportunities far more cheaply than just in the other times. The upside is you and prevent any longer financial support losses with this currency.

The price benefit of a beneficial 401(k) financing ‘s the exact carbon copy of the interest rate billed towards the good equivalent personal bank loan minus any destroyed money income toward dominating you borrowed.

Can you imagine you could potentially pull out a lender unsecured loan otherwise grab a cash loan of a credit card within a keen 8% interest rate. Your own 401(k) portfolio is creating a great 5% return. The cost advantage to own credit regarding the 401(k) bundle will be 3% (8 5 = 3).

When you can guess the prices advantage could well be positive, an idea financing might be glamorous. Just remember that , so it computation ignores one income tax perception, which can enhance the bundle loan’s advantage due to the fact consumer loan interest try paid down which have just after-tax bucks.

ความเห็นล่าสุด