A home equity personal line of credit, frequently referred to as an excellent HELOC on financing industry, is one of the most prominent refinancing a mortgage and house guarantee loan choices. HELOC. Good HELOC mortgage is essentially credit cards in which the credit limitation is personally linked to security of your house. It functions as a beneficial revolving way to obtain loans, so that you can take away finance, outlay cash back, and you can repeat as required.

Family Equity Draw and you may Payment Symptoms

The fresh new terms of good HELOC financing try split on the a couple of parts-the new mark months together with installment months. The newest draw period was a-flat several months (always between five and ten age) whenever you can withdraw financing, if you find yourself merely being responsible for paying interest. At the conclusion of the fresh new draw period, you are able to enter the cost several months, that is while you are up coming guilty of expenses both principal and you may focus wide variety.

Changeable Interest rates

HELOCs enjoys an adjustable interest rate, therefore it is tough to budget correctly and ensure you can afford your instalments. The changeable interest renders HELOCs a risky choice because it’s impractical to anticipate just what market and you may savings will look particularly subsequently.

Perhaps one of the most distinguishing attributes of an effective HELOC is the fact unlike taking out fully a big share at the same time, your transfer guarantee as you need they. This really is advantageous because you would not pay focus towards the finance you do not end using.

3. Cash-Aside Re-finance

The way to learn a money-aside home mortgage refinance loan is to think of it as a means to pay off your own house’s established home loan having a top one. Using this solution, the real difference when you look at the worth will go in to the pouch, and utilize the fund as required. It’s fundamentally undertaking the first financial processes again as you are accountable for the brand new rates of interest, financing name adjustment, and you can fee dates.

- How much security you have got of your house

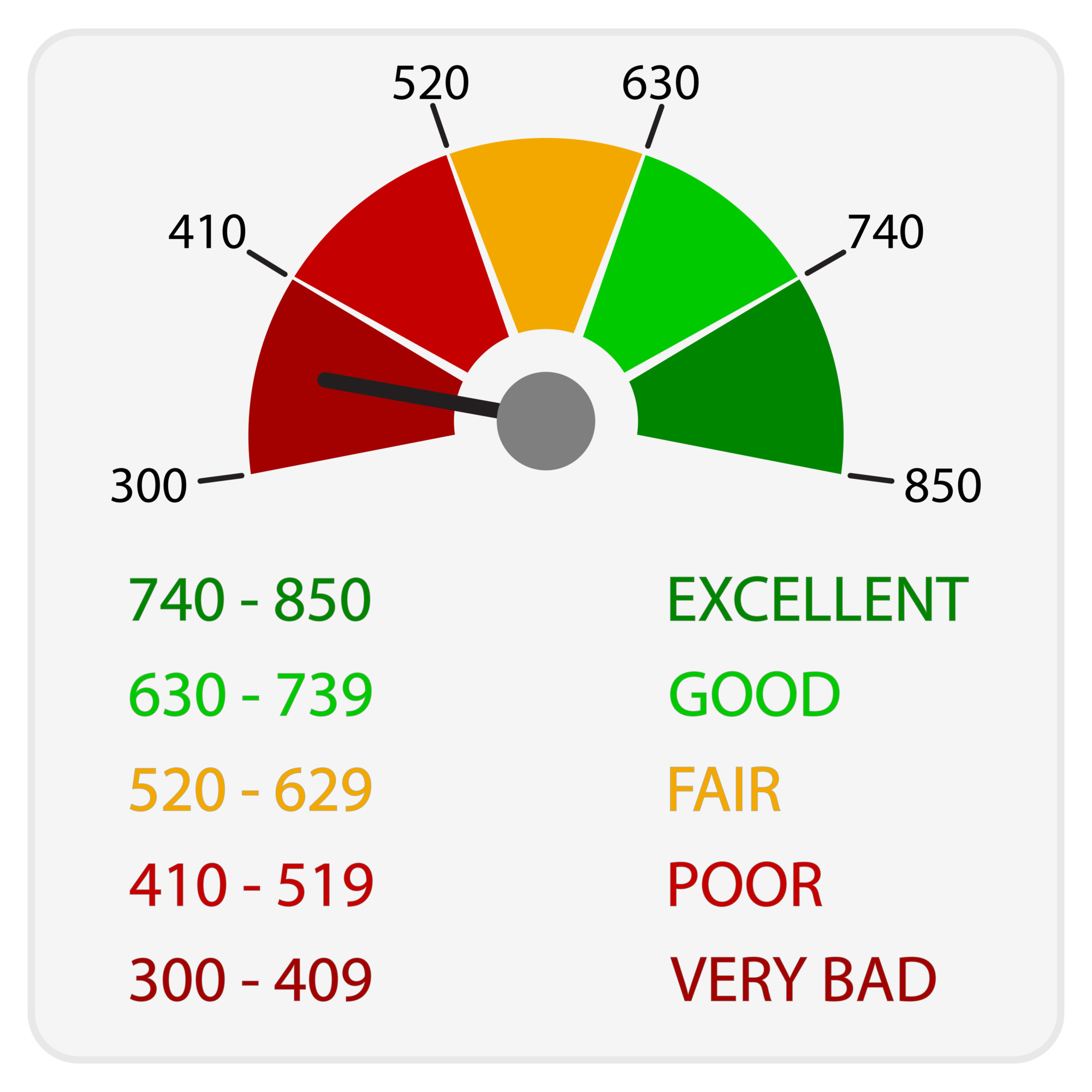

- Your credit score

- Bank otherwise home loan company conditions

Transforming guarantee from this brand of home payday loan Branson loan refinance will be an enthusiastic glamorous choice whilst have a tendency to comes with top financing term stipulations minimizing interest levels. That said, the newest costs, approval process, and you may certification conditions regarding the a funds-away refinance mortgage set that one out of reach for some residents. You will need to weigh out the complete advantages and disadvantages if you find yourself opting for ranging from a funds-refinance vs. a home guarantee financing or other options.

4. Opposite Mortgage

Actually concept of playing with family security having senior years? While avove the age of 62, you will be eligible for an opposing mortgage. Whether your web worthy of are covered right up of your property guarantee, but you would want to gain access to most funding via your senior years, this will be a alternative.

What is actually a contrary mortgage, precisely? An opposing home loan try cutting-edge, in addition to best way to conceptualize exactly how you to works is within the name in itself-they have been home financing that actually works backward. In lieu of expenses a fixed month-to-month homeloan payment to your home loan bank, the lender sends you a payment.

- A payment

- A lump sum

- Term payments

- A credit line

- A mix of these types of formations

As most older residents don’t have a lot of income, money off a contrary mortgage can help make ends up see making life warmer. But not, nonetheless they feature a high interest rate and may maybe not getting suitable for anyone.

Because you decades, your debt rises and your equity decreases, that is the reason this process from transforming collateral is made specifically to have elderly residents. In case your debtor motions otherwise dies, the fresh proceeds of your marketing go to your trying to repay the reverse home loan. While you are young than simply 62, there are many more options so you’re able to opposite mortgage loans that one can believe.

ความเห็นล่าสุด