Head Operating Officer, Corcoran Reverie

?Perhaps one of the most essential procedures so you can effectively purchase a home is to get pre-approved for home financing prior to shopping for homes.

The main reason to locate pre-accepted getting a mortgage prior to trying to find property would be to be sure you are looking at homes that will be for the finances one you really can afford. Even in the event a purchaser will get pre-accepted to have a home loan ahead of looking for home does not always mean there try a vow they’ll effectively obtain the funding. Certainly the guarantee ‘s the when the a lender pre-approves a purchaser that visitors will effortlessly have the investment, yet not, it will be easy a mortgage could possibly get rejected even with pre-recognition.

A home loan you to definitely will get refused the most preferred factors a genuine house offer drops as a result of. Whenever a consumer’s financial was denied once pre-acceptance, its quite often the latest blame of the buyer and/or bank you to definitely pre-recognized them.

Some of the explanations a mortgage was declined once pre-acceptance are already fairly prominent. Below there is widely known causes home financing are refused once pre-recognition so if you’re familiar with what they’re, you are able to reduce the possibility that their mortgage is actually declined even once a good pre-recognition!

One of the most common factors a mortgage is denied is because of a change in employment. With respect to the type of investment a buyer are obtaining, there are certain criteria to possess period of consistent employment. For example, FHA mortgage loans want a purchaser getting good a position history to have two years. In the event that you will find openings inside the employment record, needed a created need which is at the mercy of this new recognition regarding a mortgage underwriter.

A change in work possibly appropriate occasionally if it is in a similar job. Eg, if a buyer that is a nurse changes hospitals but stays a nurse, for as long as there’s not a drastic improvement in earnings, really lenders https://cashadvancecompass.com/payday-loans-fl/ could well be Ok using this transform regarding a career.

Has just if you find yourself selling a house for the Brighton, Nyc, a buyer turned employers once getting pre-approved and you can completely turned community industries, and that triggered the mortgage getting refuted.

It is important that a buyer who is pre-approved asks the mortgage agent from the a prospective a position transform just before deciding to make the transform. Usually, a top mortgage associate should be able to expect whether or not around was an issue with eventually obtaining financing or otherwise not.

A very popular property myth is that you you need prime credit to shop for a home. It is not real, but not, there are certain credit score guidelines that every sort of home loan will have and now have recommendations that every financial will receive.

Perhaps one of the most preferred explanations a mortgage was denied is on account of a terrible impression so you can a buyers credit score. Its very important you to definitely a buyer knows what its credit rating occurs when it score pre-acknowledged and get a strong knowledge of exactly how fico scores impact mortgage loans.

A purchaser who’s got a credit score on lower 600’s should be a lot more careful when they score pre-recognized they own zero negative affects on their credit. Indeed a purchaser with scores on 700’s will be careful also, yet not, there is needless to say somewhat a change between a beneficial 610 and you will 710 credit history.

Summation, if you were pre-acknowledged, still definitely pay the bills punctually and also watch what your credit score try. A well-known web site you to checks credit for free is actually Borrowing from the bank Karma. Discovering weekly just before an objective closure that the financing might have been denied are going to be disastrous!

Corey Marie Birger

A separate very common need a home loan is refuted after a good pre-recognition is mainly because a purchaser performs a lot more loans. Inquire one knowledgeable real estate agent in the event the they’ve had one items when their consumer requires that loan away to have a unique vehicle just after they will have got its bring acknowledged to the a house. The possibility that the true house broker has actually is fairly highest.

It’s important if to purchase a property and you will you have been pre-accepted you don’t put any additional bills or credit lines. This will provides a giant influence on debt to help you money rates and eventually can cause a home loan that’s denied.

You’ll be able to that when a great pre-approval try provided you to a loan provider or home loan device may go through alter to their criteria and you may guidelines. Such as for example, if a loan provider lets a purchaser to have a great 620 borrowing from the bank get and you will alter its demands so you’re able to good 640, this leads to a home loan assertion when they desire utilize it retroactively.

Almost every other alter so you’re able to loan conditions otherwise financial guidance which could direct in order to a mortgage being declined once pre-acceptance are priced between;

- Loans so you’re able to income guideline transform

- Amount of supplies (savings) needed of client

It varies from bank so you’re able to bank, not, some lenders often procedure a home loan pre-acceptance to possess a purchaser at the mercy of an acceptable lender assessment. The fact is that there is certainly issues with the bank appraisal. Nearly all theissues that have a bank assessment try pretty common.

Has just into the business away from a house in the Irondequoit, Ny banking institutions appraiser cited a gas channel that has been inside close proximity towards topic property. That the consumer are getting a keen FHA mortgage and that did not support a gasoline station are in this a particular range, and that fundamentally lead to the mortgage are rejected. Thank goodness, the customer been able to key brand of funding in order to good conventional home loan merchandise that didn’t have a problem with new distance of the fuel route.

Naturally this can be only 1 illustration of a problem with a beneficial bank appraisal that lead to a mortgage getting declined. There are many other factors home financing is refuted immediately after pre-acceptance on account of an appraisal point.

A familiar matter that is expected of the homebuyers is actually, How do i be certain that my home loan is not refused. A very good way to ensure their financial actually denied immediately following an excellent pre-acceptance is to try to continue doing that which you performed in advance of delivering pre-approved. The majority of mortgage brokers do a good occupations to make sure a majority of their pre-approvals make it for the closure desk.

- You should never deal with extra lines of credit

- Cannot raise your expenses

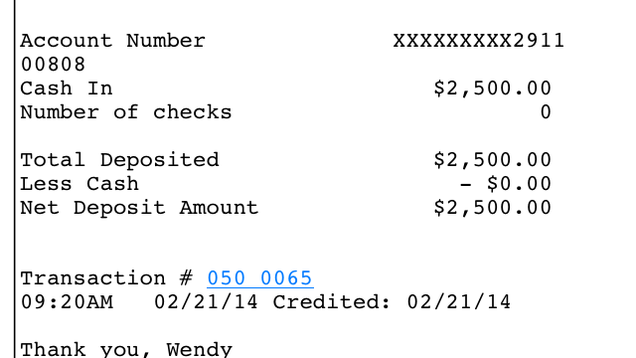

- Try not to make large dumps into your bank accounts with out research on in which they came from

- Try not to withdraw huge amounts of money from your own bank account

- Consistently save money when your closure expenses try more than to begin with estimated

- Provide most of the asked records in order to lender when you look at the punctual styles

It could be disastrous to have a beneficial pre-approved consumer to possess the financial declined in the very last minute. The aforementioned most readily useful 5 reasons home financing try rejected just after pre-recognition will likely be averted. You will need to understand why mortgages get declined once pre-approval and that means you dont create such problems.

Before making any conclusion which could perception your financial situation, speak with often the financial top-notch or real estate professional. Normally this will stop you from making a decision that may effect no matter if the mortgage is rejected.

ความเห็นล่าสุด