The Milliman Mortgage Standard Index (MMDI) is an existence default rates imagine computed on mortgage level getting a portfolio out-of unmarried-friends mortgages. Into the purposes of that it directory, standard means that loan that’s likely to feel 180 months or even more unpaid along the longevity of the borrowed funds. step 1 The outcome of your own MMDI echo the most recent analysis purchase available from Freddie Mac computer and you may Fannie mae, which have dimensions times which range from .

Trick findings

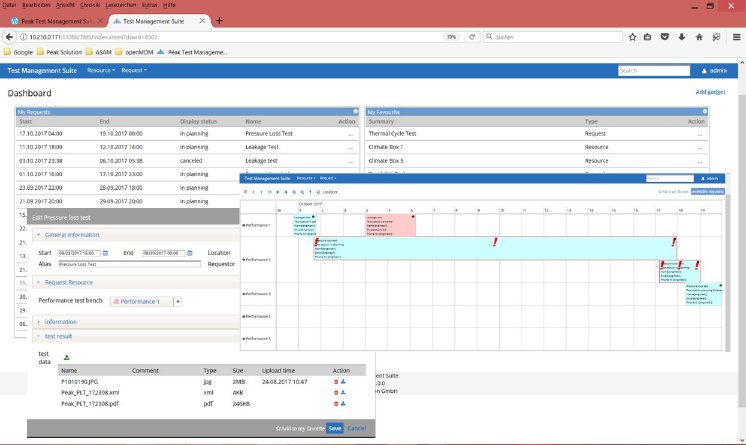

To own loans received throughout the 3rd quarter (Q3) of 2023, the value of the fresh MMDI risen up to step 3.10%, upwards off step three.03% for fund gotten within the 2023 Q2. That it raise stems from a slowing and moderate decrease of household rate like projections in certain locations. Figure step one has the one-fourth-end directory abilities, segmented of the pick and you will refinance loans.

Whenever looking at quarter-over-quarter changes in brand new MMDI, it is important to note that the newest 2023 Q2 MMDI beliefs were restated because the the past publication, and you will were adjusted regarding 3.02% to 3.03%. This is exactly a direct result upgrading one another genuine domestic rate moves and you will predicts to own coming family rate appreciate.

Overview of styles

More 2023 Q3, all of our most recent MMDI overall performance demonstrate that home loan chance has grown to possess government-sponsored company (GSE) acquisitions. You’ll find three areas of the brand new MMDI: borrower exposure, underwriting risk, and you will monetary risk. Borrower exposure procedures the possibility of the mortgage defaulting due to borrower borrowing quality, 1st collateral condition, and you can debt-to-earnings ratio.

Underwriting exposure steps the possibility of the borrowed funds defaulting due to financial product features instance amortization sorts of, occupancy status, and other issues. Financial risk methods the possibility of the mortgage defaulting because of historical and you can anticipated economic climates.

Debtor exposure performance: 2023 Q3

Borrower risk Q3, that have buy funds carried on while making within the bulk of originations at about 89% regarding overall volume. Even though buy frequency might have been coming down season-over-12 months, the quality of funds out of a danger perspective features continued so you can end up being strong, remaining new standard danger of new financing originations low.

Underwriting chance show: 2023 Q3

Underwriting chance is short for a lot more exposure modifications to have property and mortgage characteristics such as for example occupancy reputation, amortization variety of, documents types, loan term, or other customizations. Underwriting chance stays reasonable which can be bad for sale mortgage loans, which can be full-files, completely amortizing financing. To have re-finance finance, the information is segmented into cash-away refinance loans and you will speed/identity refinance finance.

Which one-fourth, just as much as 70% from re-finance originations was basically bucks-aside re-finance money. Present expands for the rates of interest have made rate/term refinance non-monetary.

Monetary exposure performance: 2023 Q3

Financial chance try mentioned from the looking at historic and you can predicted household costs. To have GSE fund, monetary chance enhanced one-fourth more one-fourth, from.54% inside 2023 Q2 to one.64% into the 2023 Q3. After the increase inside the casing costs that took place over the way of pandemic, house rates really love could have been estimated in order to slow and also somewhat decrease in some locations. The brand new estimated reduction of domestic rate fancy has actually brought about a small escalation in standard chance for 2023 Q3.

For more information on the newest housing marketplace, excite refer to our very own current Milliman Insight post, Anticipating the latest housing industry: A monetary frame of mind out of casing value and you may home values offered by

Brand new MMDI shows a baseline prediction of coming home prices. With the the total amount actual otherwise baseline predicts diverge throughout the newest prediction, upcoming products of the MMDI will change appropriately. To get more outline to the MMDI elements of risk, see milliman/MMDI.

Regarding the Milliman Financial Standard List

Milliman was professional into the taking a look at state-of-the-art studies and you will building econometric models which can be clear, user friendly, and you may academic. I have utilized our very own options to simply help several readers inside the development econometric models to possess researching home loan exposure each other from the point regarding marketing and for knowledgeable mortgages.

The fresh new Milliman Home loan Default List (MMDI) uses econometric acting to grow a dynamic design that is used because of the customers https://cashadvancecompass.com/installment-loans-ms/ in numerous implies, along with viewing, overseeing, and you may positions the financing quality of the development, allocating repair present, and you can development underwriting guidelines and you can cost. Since MMDI produces a lifestyle standard rates imagine at the financing height, its employed by website subscribers while the an excellent benchmarking device within the origination and you will servicing. The latest MMDI try created from the consolidating three key elements off financial risk: borrower borrowing top quality, underwriting properties of your own home loan, therefore the monetary environment made available to the mortgage. The new MMDI spends a powerful analysis gang of more than 31 billion mortgage loans, that’s up-to-date appear to to make certain it keeps the greatest peak out of precision.

Milliman is one of the premier separate consulting providers regarding globe and contains developed procedures, equipment, and you may alternatives global. We have been acknowledged leaders regarding the segments we serve. Milliman opinion has reached around the globally borders, offering official contacting services when you look at the home loan financial, employee masters, health care, term life insurance and you can financial features, and you will assets and casualty (P&C) insurance. In these groups, Milliman specialists suffice an array of most recent and you can emerging segments. Members learn they could confidence all of us given that skillfully developed, respected advisers, and inventive problem-solvers.

Milliman’s Home loan Habit are seriously interested in getting strategic, quantitative, or other consulting attributes to best communities regarding financial financial world. Prior and latest subscribers become certain nation’s biggest financial institutions, private home loan guarantee insurance providers, financial warranty insurance firms, institutional people, and governmental organizations.

step 1 Eg, whether your MMDI is ten%, next we anticipate ten% of your own mortgage loans originated that month to be 180 months or maybe more outstanding more than its lifetimes.

ความเห็นล่าสุด