What exactly is a minimal deposit mortgage as well as how does it work with me personally?

A decreased deposit mortgage makes you get property that have a smaller initially commission than simply is usually requisite. This is exactly helpful if you are searching to purchase a property but have not secured a massive put. It assists your go into the property field sooner and start strengthening equity of your property.

Exactly what are the advantages of a decreased put financial?

They’re including beneficial getting very first-day home buyers otherwise those who have maybe not managed to cut a hefty deposit.

- Increased the means to access: Permits more individuals purchasing property at some point by reducing the number of offers necessary initial.

- Sector entry: Lets consumers to get in the house or property industry from the most recent costs, probably capitalizing on business development and you will increasing security over time.

- Autonomy when you look at the offers: Gives the possibility to invest or allocate deals to many other needs otherwise monetary options, in lieu of only centering on racking up a big put.

- Possible bodies bonuses: Commonly entitled to various regulators software one to support reasonable deposit borrowing from the bank, cutting extra costs such Lenders Mortgage Insurance rates (LMI).

Which are the drawbacks regarding a home loan that have the lowest put?

Lenders with reduced places helps make to purchase a property far more accessible, even so they come having particular change-offs one borrowers should consider. These types of cons include prospective a lot of time-name economic impacts.

- High overall will cost you: With a smaller initial put, you may want to end borrowing more and ergo using much more attention across the life of the borrowed funds.

- Loan providers Home loan Insurance coverage (LMI): Most lowest deposit money require that you pay LMI, hence handles the financial institution but may create a serious costs so you’re able to the loan.

- Increased monthly premiums: As you are investment more substantial count, the monthly money will generally become large as opposed to those off that loan that have a larger deposit.

- Possibility bad equity: If the assets thinking fall off, you could find your self owing on their financial than just your house is well worth, particularly if you have made an inferior deposit.

- Stricter qualification criteria: Loan providers can get impose more strict borrowing and you can income tests so you can counterbalance the threat of a diminished put, possibly therefore it is more challenging additional resources so you’re able to qualify for the mortgage.

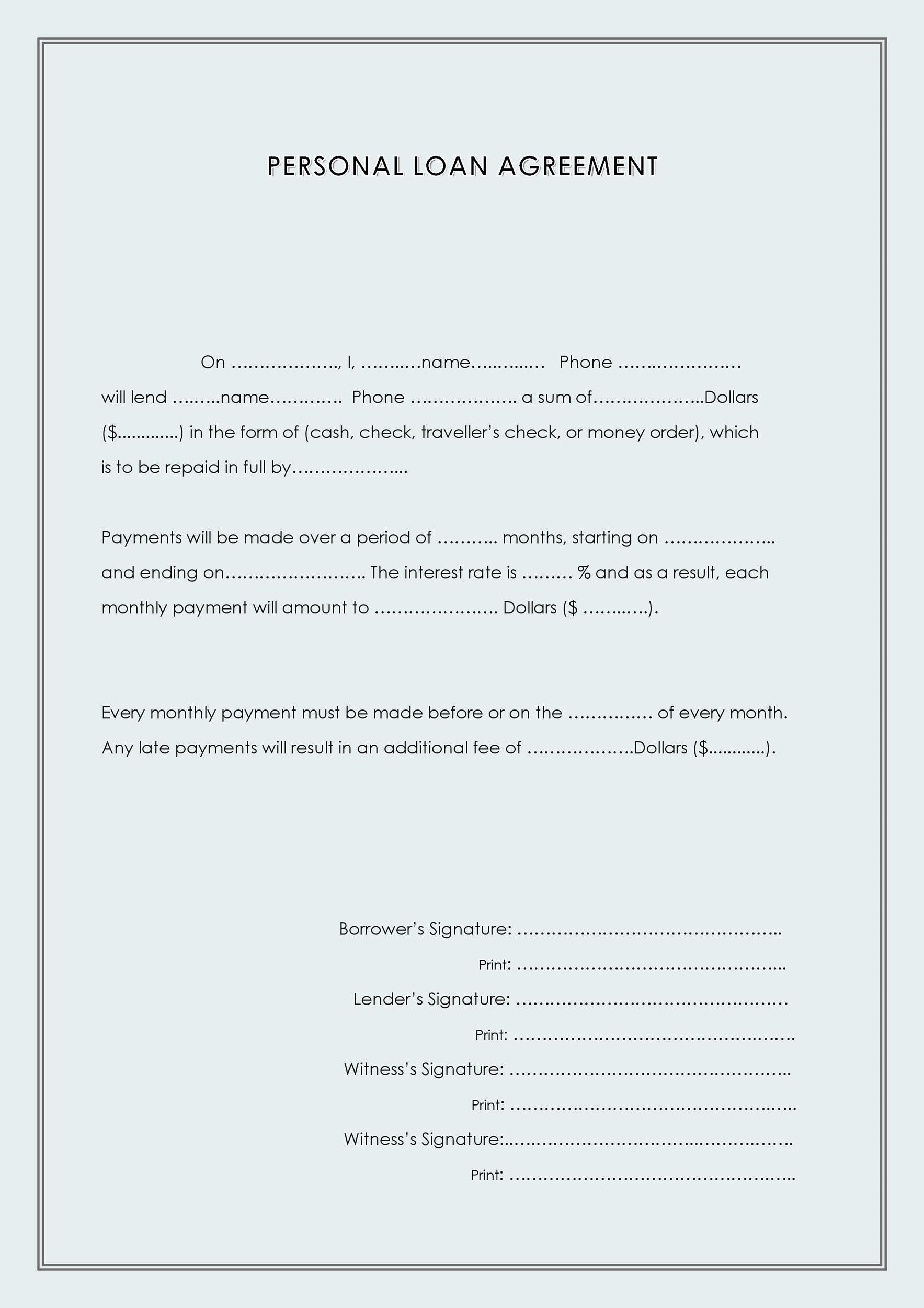

Was We entitled to a decreased deposit home loan which have Rapid Fund?

Eligibility hinges on numerous factors together with your money, credit rating, a position position, almost every other possessions you ount out-of put you really have conserved. We think about Centrelink costs as the income below particular requirements.

It is advisable to complete the Totally free Financial Testing, on top of this page, to begin with, and we are able to remark your bank account, needs and you can specifications to help you from the 2nd steps readily available for you.

At Fast Loans, we have more twenty years expertise handling people who have all of the kinds of questions away from care about-a position to bad credit histories to assist them to see mortgage brokers that work to them.

What’s the lowest deposit you’ll need for a reduced put domestic mortgage during the Fast Loans?

On Fast Financing, minimal put required for a minimal deposit mortgage normally begins out-of 5% of purchase price of the property. Yet not, this count may differ based on your individual factors, the loan product, as well as your qualification less than certain criteria.

To help expand assistance to the acquisition, you happen to be qualified to receive regulators systems including the Basic Domestic Be sure, Local Household Make certain, or the House Be certain that, which can will let you purchase a home which have an even lower put. These types of apps are made to reduce the hindrance so you’re able to entryway with the brand new housing marketplace, especially for very first-day customers and those for the specific lifetime affairs, eg unmarried parents. Around such schemes, the us government generally will act as a great guarantor to have a fraction of the borrowed funds, potentially removing the need for Loan providers Financial Insurance (LMI) and you will decreasing the put needs.

ความเห็นล่าสุด