If you have a very clear name to your automobile, boat or any other investment, you have a financial investment that you may have skipped therefore much. For those who lack the advance payment a large number of old-fashioned loan providers need, you may have a harder day taking approval.

Based on sector conditions, specific loan providers which are happy to money auto, ships and other property so you’re able to provide some cash.

What’s a subject Loan?

Financing where an applicant spends a secured item including a auto, motorbike, rv, otherwise watercraft to safer that loan.

What makes label finance popular?

First Usually, you don’t need to has a credit history. You just need to possess obvious label so you can a car or truck.

3rd Occasionally all you have to would is give-up the fresh new identity. According to financial, you do not even have supply your some points.

What makes name finance therefore offensive?

Really, you certainly need certainly to pay attention to the rate of interest. Particular provinces limit the speed that a concept financing lender can also be costs, however you definitely should take a look at the conditions and terms regarding the rates, fees, fees and stuff like that.

If not meet your mortgage obligations, the financial institution has the ability to grab the automobile getting used due to the fact guarantee. In the meantime, a lien gets in your car or truck name if you do not has paid down which financing in full.

And, you don’t get an entire worth of the car in the financing. Often there is a threshold place during the a certain portion of the car’s worthy of.

Amansad Financial does not provide identity loans given that a family, but we do have contacts which have financial support provide that offer title fund toward brief see.

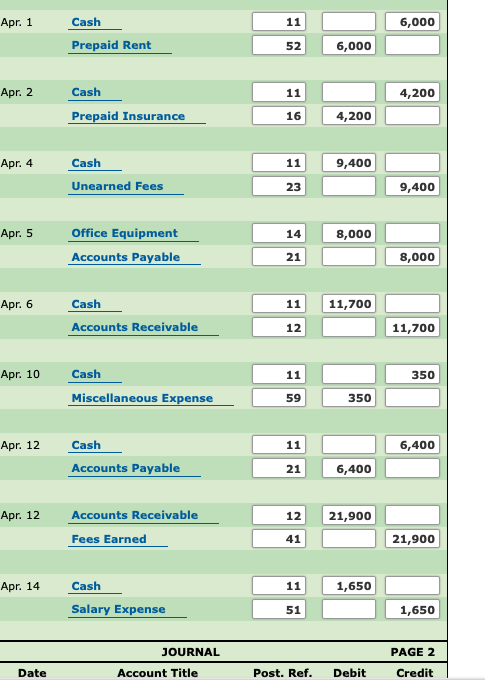

Just how does this new name financing process works?

A lender will be sending away an enthusiastic appraiser to view everything have in mind once the equity and then provides you with a lending decision. For individuals who disagree toward appraisal, you are not obligated to make the loan. Yet not, for many who https://clickcashadvance.com/payday-loans-ms/ agree to the fresh new appraisal additionally the regards to the new mortgage, merely change brand new label for the loans. So long as you keep up with the money promptly, just like any car mention, you can acquire the latest title when you really have fulfilled the fresh new terms of the loan.

Do you know the conditions to own a title loan?

- Your car can’t be older than seven age

- Clean identity (note: when there is a very small lien, financial will get just choose repay it and you can check in its lien)

- Legitimate license

- Owner is at minimum 18 yrs . old

- Manager possess an entire exposure insurance coverage

- Duplicate membership documentation to ensure ownership

What files perform people need to provide?

- Constant money. Meaning at least a couple spend stubs, a verification page out-of an employer or something like that equivalent.

- Proof of residents, including a mortgage otherwise rent, a few different forms of regulators-provided character and you can a nullified have a look at.

- Confirmation away from Ownership and Updates of your own Investment (May vary with respect to the investment becoming bound)

Do you know the newest interest rates?

There’s a range about, according to types of equity your debtor is using. Right now, the range goes out of dos.5 so you can cuatro.3 % a month.

Do you have to focus on my personal credit history?

A loan provider can get create a credit check, although rating doesn’t determine the choice even in the event to cover the borrowed funds.

Exactly how ‘s the loan amount determined?

You can find algorithm one to regulate how much the general well worth are for vehicle which go right up because security. Some other property, evidence of certified philosophy, and then Financial normally give up to on 40 percent off that really worth. The more beneficial this new advantage, the better brand new percentage was.

Is these types of funds when the I am for the a retirement otherwise impairment payments?

Sure. But Lenders will want to see the debtor has left a constant residence record, therefore are more likely to require an effective co-signer.

ความเห็นล่าสุด