To order a house to fix up-and flip to have an income or rent out so you’re able to visitors are an ideal way from creating extra money. If you can’t be able to pay money for a house beforehand, a residential property financing can help you financing these pick.

We have found a closer look during the what’s working in an money spent financing so you’re able to find the right home loan to possess forget the goals.

Identifying Investment property Fund

An investment property mortgage try home financing which is used so you’re able to get property that may build income. It is generally speaking useful to acquire a house to renovate and you may up coming bring in an income, which are often known as home turning, or even generate leasing money.

Understand that an investment property mortgage is suitable to have properties where the manager won’t be way of living. In the event you propose to buy a beneficial multifamily funding domestic and you can live-in one of the tools if you are renting the rest out, a simple mortgage program may be a better fit.

What’s A residential property?

In order to satisfy the term a residential property, the true property can be used and then make a full time income. Some of the most preferred family sizes which might be utilized once the residential money properties were multifamily homes, cooperatives, are manufactured land and you will condos.

Money spent credit is considered riskier than number one quarters fund, for example people will need to show deeper economic balances. The following is a peek at some of the standard conditions to possess getting a residential property mortgage.

Down payment: However some property loans, such as for instance FHA and you can Va funds, simply need 3.5 per cent down repayments, very loan providers want borrowers to place no less than 20 percent down for the money spent finance. Also, gift ideas commonly welcome; the bucks have to all the belong to brand new applicant.

Mortgage reserves: Loan providers want to see proof one a borrower features adequate currency on bank to fund between one or two and you can half a year worthy of off mortgage repayments. The particular amount depends upon exactly how many functions the newest debtor is the owner of.

Credit score: Individuals requires a credit score with a minimum of 640 for money spent money. Although not, for those who are to purchase multifamily land, a credit history with a minimum of 700 may be required.

Possessions Management Record: For almost all form of financing, consumers was asked so you’re able to file the feel leasing properties. Specific lenders may even wanted consumers presenting taxation statements to prove they have handled rental residential property previously.

Obtaining An investment property Mortgage

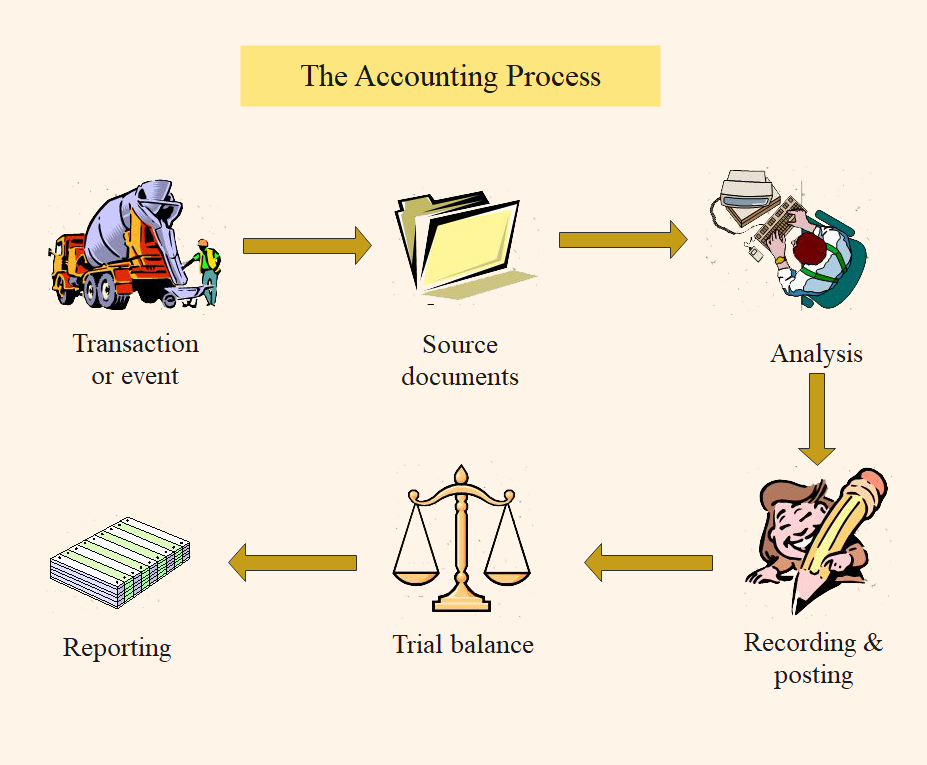

The process of getting a residential property mortgage is somewhat a great deal more difficult than a fundamental domestic home loan. The following is a brief overview off just what it requires.

Finding the optimum Money spent Mortgage lender

Extremely lenders give investment property money, but their cost can differ most. Of many individuals discover a region bank is the ideal alternatives, especially for individuals who could possibly get flunk toward a number of the conditions. Community financial institutions are apt to have greater flexibility and additionally good vested interest in using in your community.

Filling out An application And you will Providing Files Out-of Property

Since the borrower enjoys understood a loan provider that meets their demands, they need to complete an application. New borrower might be requested to add most paperwork of its assets, such as for instance months off lender statements, together with information about the property he is to purchase, particularly renting and you will leasing advice.

Acquiring An assessment

The process of appraising property and is useful for a good investment is really comprehensive, and it also is sold with revealing details on the typical rent most other residents is collecting for the comparable homes in the neighborhood. So it statement also have compelling proof that the financial support try a great sensible one that can have a life threatening effect on installment loans online in Ohio the latest borrower’s chances of being qualified.

Reviewing The fresh new Closure Revelation

Adopting the house has been appraised, the financial institution deliver an ending revelation on the months leading doing the state closing. Individuals have to comment that it document carefully to ensure the figures align the help of its traditional. It is reasonably important to guarantee that the terminology are obviously knew, especially for those who was working with an arduous currency bank.

Closing

Consumers are needed to bring the requisite loans into closure when it comes to an excellent cashier’s see or publish the new money through cable transfer in advance. From the closing, files would be signed additionally the investment property could well be registered from the borrower’s term.

Discuss Your investment Requires Together with your Society Bank

Woodsboro Lender try purchased your regional groups and you can businesses, and you can specializes in getting consumers that have solutions which might be customized so you’re able to help them meet their financial support needs. Call us today to agenda an appointment having an experienced financing assets financing expert to begin.

ความเห็นล่าสุด