Mortgage prequalification is the 1st step regarding home loan processes, in which a loan provider provides a great ballpark estimate regarding exactly how much household you really can afford. Mortgage prequalification is typically easy and quick. You don’t have to bring documents towards the financial, and also you just address several quick questions.

By teaching themselves to prequalify to have a mortgage, especially if you’re an initial-big date house visitors, you could potentially search for residential property inside your correct finances, to stop dissatisfaction more than expensive choices.

Ideas on how to prequalify to possess home financing as the a primary-go out buyer

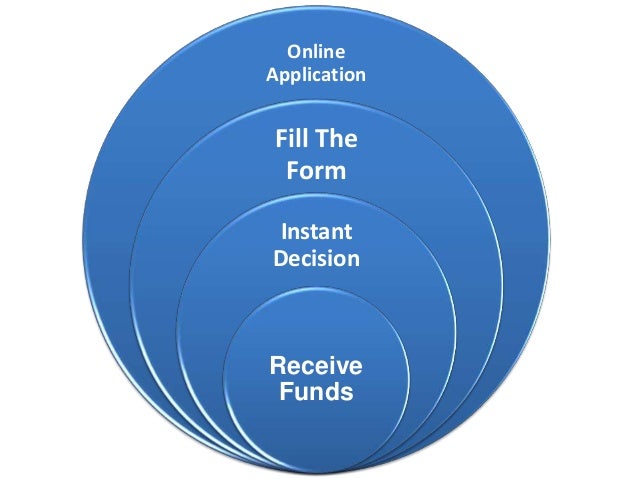

For many home buyers, step one in order to as people is payday loan Hawleyville home loan prequalification. But how might you prequalify to own home financing? Luckily that it’s a simple process that may continually be over on the internet.

As opposed to mortgage preapproval, prequalification try faster rigid and loan providers cannot typically want a deep dive to your consumer’s monetary suggestions. Here are the general measures in order to prequalify to possess home loans.

The initial step should be to explore various lenders. This may involve traditional banks, borrowing unions, and online lenders. For every lender you are going to promote different terms and interest levels, therefore it is beneficial to examine a few options to obtain the greatest complement.

dos. Give monetary guidance

In order to prequalify for mortgage brokers, lenders normally consult basic economic advice and make contact with advice. This could tend to be their monthly income, property, debt repayments, and perhaps your credit rating diversity. Mortgage prequalification cannot always want economic paperwork to confirm what; self-stated facts are usually sufficient.

Once you’ve recorded the online prequalification means, the financial institution may carry out a silky credit score assessment. These types of inspections don’t connect with your credit score and are generally a means to possess lenders to help you pre-display screen candidates to find out if it meet the very first qualifications to possess homeownership.

step three. Lender’s evaluation

With the individual financing information provided, the fresh underwriter often determine your own creditworthiness and you will assess an effective tentative loan number you happen to be eligible to obtain. Which evaluation may possibly include conversations from the you are able to financial alternatives, financing terminology, therefore the particular interest levels offered (repaired cost vs. changeable prices).

4. Discover an effective prequalification letter

In case your financial identifies you happen to be the right applicant to possess a property loan, they are going to situation a good prequalification page. So it document contours the brand new projected amount borrowed you can be eligible for. You will need to keep in mind that which letter is not a guarantee regarding loan acceptance, because it’s considering original economic information.

It seems sensible to obtain prequalification characters from several lenders so you’re able to contrast loan products. This also will provide you with a good ballpark contour away from just what some other lenders faith you really can afford, which is helpful in budgeting for your coming domestic.

5. Utilize the home loan prequalification to aid your house browse

With an idea of the mortgage number you might be qualified for, you could potentially most readily useful appeal your property explore properties within your finances. This may save your time which help you put realistic standard very early at your home-to shop for procedure.

Difference in prequalification and you will preapproval

Many people utilize the conditions prequalify and preapproval interchangeably, yet , they may not be a comparable. Becoming clear, neither that guarantees a mortgage. For procedure, you can offer private and you can financial recommendations to help you that loan manager. The difference, no matter if, is the fact lenders feet prequalifications on the mind-reported guidance. This basically means, the lending company does not make sure this post.

Whenever should i prequalify to own home financing?

Deciding whether to prequalify getting a mortgage largely depends on the readiness first off the home to find procedure. If you’re considering buying a home in the future, prequalifying can provide rewarding wisdom into your borrowing ability and help your dictate an appropriate finances.

ความเห็นล่าสุด