Invited!

- Real estate Element

- Sponsored

- Residential property

This process carries a number of exposure, therefore people may benefit out of dealing with a financial specialist so you can influence their finest routes forward.

Packing.

Personal credit card debt you certainly will give up the latest monetary safeguards and better-becoming away from many people. With respect to the Federal Set-aside Bank of new York, Americans’ full credit card harmony regarding next one-fourth regarding 2023 is over $1 trillion, and you will LendingTree profile that the mediocre charge card balance among You.S. cardholders from inside the was $7,279. Average balances was lower but still a problem into the Canada, in which studies off TransUnion means an average cardholder got an outstanding balance off $3,909 by the first one-fourth of 2023.

An average mastercard stability in the brand new U.S. and you may Canada highly recommend of a lot people are getting its monetary futures when you look at the jeopardy because of the relying too greatly with the borrowing to pay for their lifestyles.

Ascending obligations ‘s the the newest reality

Loans has been a major matter for home all over Northern The united states. Men and women are are struck because of the large will cost you everywhere, that’s compounding loans. Those people concerned with their personal debt normally consult with a financial top-notch as they seek to gain command over the finances.

$ trillion Complete domestic financial obligation about 3rd quarter out of 2023 when you look at the the us, largely driven because of the mortgage loans, handmade cards and education loan stability. The fresh new Federal Set aside Lender of the latest York Heart for Microeconomic Data

$21,800 History year’s average loans per individual, leaving out mortgage loans. This number is off out of $30,800 in 2019. Northwestern Mutual

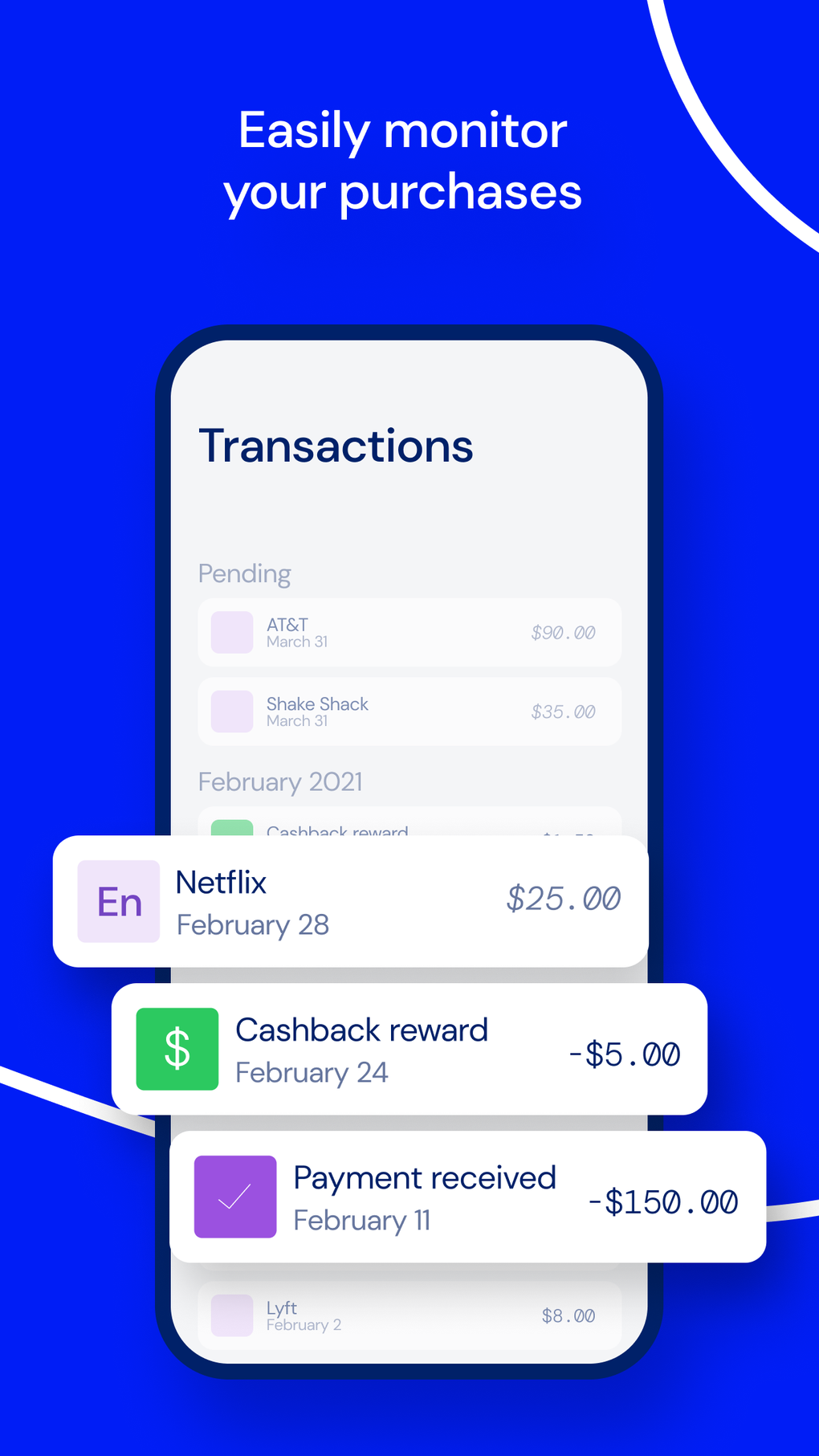

The good news is users are apt to have a feeling of self-feeling regarding their borrowing incorporate, given that a current NerdWallet survey of more than 2,000 adult consumers learned that 83 percent from respondents recognized it overspend. Recognition away from an over-reliance on borrowing might possibly be a solid first step toward eradicating personal debt, and you may consumers which very own their houses will get consider house guarantee fund otherwise lines of credit so you’re able to tame their financial obligation.

The consumer Economic Coverage Bureau notes one property security financing lets property owners to borrow cash making use of the security in their home as the security. Guarantee is the number a property is currently worth without the amount currently due with the a mortgage. Anytime a home deserves $five hundred,000 and you can residents have a mortgage equilibrium out-of $300,000, then their security try $two hundred,000.

One of the largest inquiries whenever users wrack right up an abundance of credit debt ‘s the chances that they’ll wind up expenses ample quantities of interest on that loans. That is because handmade cards routinely have higher rates. Indeed, the fresh LendingTree records that also people that have a good credit score may have an apr to 21 per cent on their credit cards. That figure merely develops to own customers having all the way down credit ratings. Bankrate notes your average interest for a property collateral financing is typically dramatically reduced as compared to rates with the credit cards, so people can commercially rescue a lot of money if you are paying off their credit debt having a home security loan.

Even if lower interest rates and you may consolidated debt are a couple of advantageous assets to settling unsecured https://paydayloancolorado.net/pine-valley/ debt that have property equity loan, this 1 are risky. Perhaps the biggest chance associated with the this process ‘s the prospective regarding losing a property. People with substantial personal credit card debt should know that without a beneficial big change in using habits, playing with property guarantee financing to pay off personal debt you are going to effect when you look at the foreclosure. In the event the homeowners dont divert previous credit using so you’re able to into the-big date month-to-month loan repayments, they may get rid of their residence. Additionally, Bankrate cards when property comes with a fantastic domestic collateral loan balance, you to definitely balance have to be paid simultaneously.

Family equity finance will help home owners combine and in the end lose its credit card debt. not, this approach sells an amount of chance, very home owners may benefit regarding handling a monetary coach so you can influence how to pay the established expenses.

ความเห็นล่าสุด