Wells Fargo has already been the greatest player in the U.S. mortgage bitions. The company is positively growing its commercial actual-property financing procedure, having particular importance getting wear are formulated home area (MHC) funding.

Here’s why the company try allocating far more tips compared to that authoritative kind of industrial a home, and you will what it you will imply to your financial and its own shareholders.

To phrase it differently, these funds are eligible to have a federal government verify, similar to residential mortgages

Wells Fargo’s dominating MHC sector shareAfter getting good $9 million industrial financing collection from General Digital when you look at the April, Wells Fargo features more $13 million off MHC fund within the profile, a dominating market share. In fact, the Zero. dos lender has actually below you to-next from the count.

For instance the GE order, Wells Fargo has on $140 million in the industrial a house (CRE) fund in portfolio — a number one display, but nonetheless just 8% of full. So it’s reasonable to state there was still room to enhance.

So you can run the fresh new MHC financing company, Wells earned several veterans away from GE Resource, hence implies it plans to to visit good information on the went on extension of their principal reputation.

Generally, a good MHC mortgage is for at the least $2 million and boasts an effective click this over here now about three-seasons so you’re able to 10-12 months financing label, amortized more than 25 so you’re able to three decades. That loan-to-worthy of ratio regarding 80% is required, but 75% is more well-known, and individuals is charged repaired rates of interest, which can be centered on current Treasury production.

- 50% out of family internet will be able to complement double-broad house.

- The house or property need certainly to offer enities.

- 85% off house sites need to be occupied.

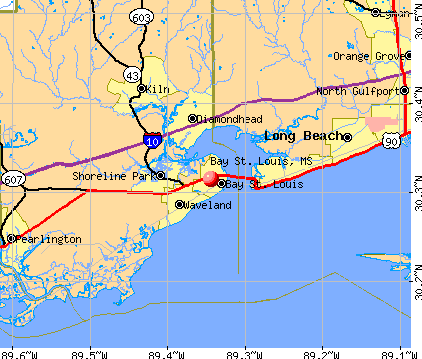

- The majority of the assets can’t be based in a flood zone.

- The house or property must draw in ample money in order to provider the debt.

The purpose of that it dialogue would be the fact many of these situations make MHC lending very safe. Indeed, Federal national mortgage association does not have any MHC financing in the default or property foreclosure, a highly epic statistic, because there are many more than $34 billion from inside the a fantastic MHC financing.

Wells Fargo’s historical run expanding while keeping charge-off and default prices reasonable, is why the business can be so looking broadening that it part of their organization.

Then, Wells Fargo thinks there are lots of unmet interest in this variety of capital, making it a good way with the financial to expand their CRE lending company about difficult low-notice environment

It might imply extra cash to have WellsWells Fargo’s Chief executive officer called the organizations purchase of the commercial fund away from GE a good “once-in-a-age bracket feel,” it is therefore fair to state the business had much, plus it seems it does benefit from its today-prominent MHC market share.

Wells Fargo’s home loan business is rather lucrative into organization, very further expansion you’ll indicate an excellent improve on the bottom line. And the attract money from its huge collection out of mortgages, the firm advantages from upkeep costs, in addition to origination fees for all of mortgage loans it creates — and therefore, given that We have said before, can be very tons of money.

Amongst the expansion of industrial a house plus the thriving domestic mortgage field, Wells Fargo shareholders could see a greater-than-questioned escalation in money along the future years. Not too investors required they, however, this can be a different reason to be upbeat regarding the Wells Fargo’s brilliant coming.

Matthew Frankel does not have any condition in any brings stated. The fresh new Motley Deceive suggests Wells Fargo. The latest Motley Deceive has shares regarding Standard Electric company and Wells Fargo. Is actually any of our Foolish newsletter services totally free getting 1 month. I Fools e opinions, however, we all believe that offered a varied selection of wisdom makes us most useful dealers. The newest Motley Deceive enjoys a beneficial disclosure rules.

ความเห็นล่าสุด